Industry-leading companies with high R&D investments, the potential to create entirely new markets, and high market share.

Companies that leverage innovation for a competitive edge, focusing on improving existing services/product offerings.

Companies that fill market gaps with disruptive products or services, have a low market share but show strong growth projections.

Key takeaway: At its core, companies innovate to increase revenue, market share, and profitability.

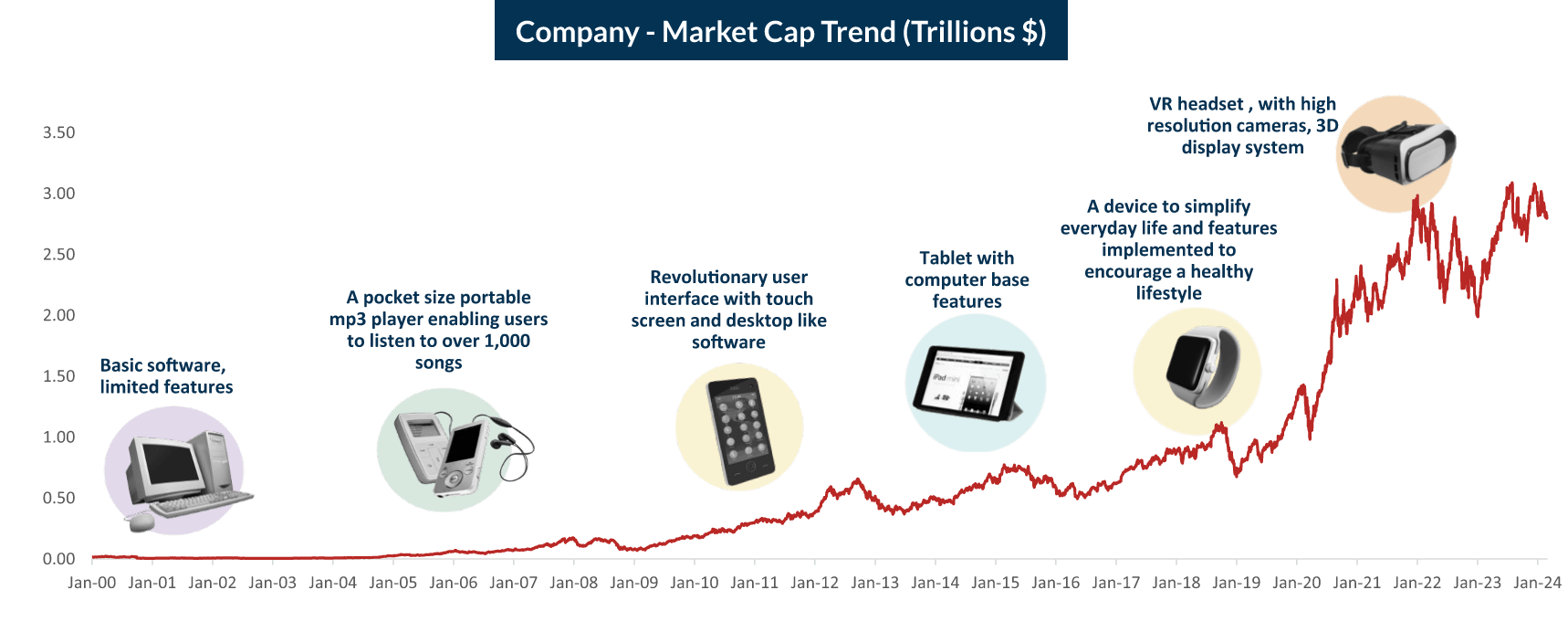

This multinational giant expanded its market cap to $3 trillion in 24 years, driven by R&D that spurred scientific innovations and patents, leading to significant growth.

Source : Bloomberg, The sectors/stocks mentioned herein are only for illustrative purposes and should not be construed as a recommendation from Bandhan Mutual Fund or indicative portfolio of any scheme of Bandhan Mutual Fund. Bandhan Mutual Fund may or may not hold any position in these sectors/stocks. Performance of the above sectors/stocks should not be construed as indicative yield of any of the schemes of Bandhan Mutual Fund. Portfolio of the fund would depend on asset allocation and investment strategy as stated in Scheme Information Document and market conditions at the time of investment. Past performance may or may not be sustained in the future.

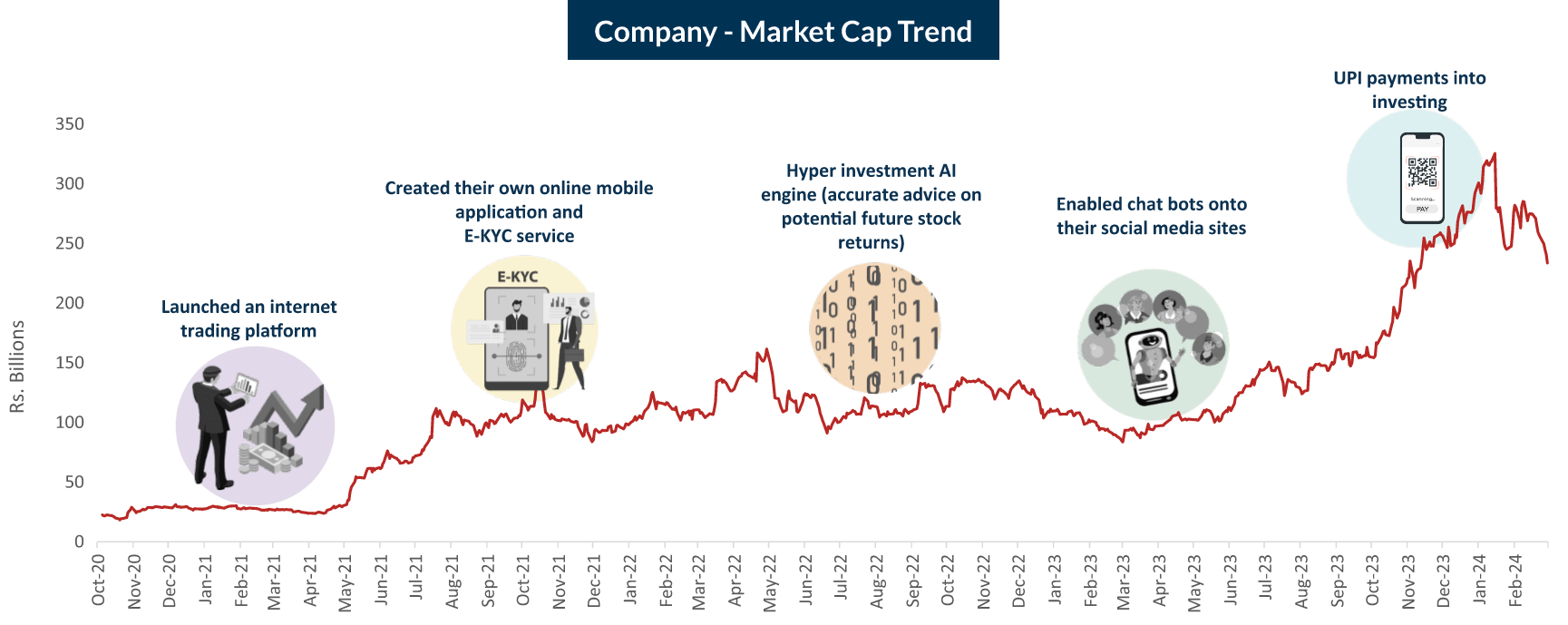

This brokerage firm innovated in digital payments, and artificial intelligence, leading to a substantial rise in its market share.

Source : Bloomberg, The sectors/stocks mentioned herein are only for illustrative purposes and should not be construed as a recommendation from Bandhan Mutual Fund or indicative portfolio of any scheme of Bandhan Mutual Fund. Bandhan Mutual Fund may or may not hold any position in these sectors/stocks. Performance of the above sectors/stocks should not be construed as indicative yield of any of the schemes of Bandhan Mutual Fund. Portfolio of the fund would depend on asset allocation and investment strategy as stated in Scheme Information Document and market conditions at the time of investment. Past performance may or may not be sustained in the future.

Digital payments have skyrocketed, with a 45% CAGR and a 2.5x volume increase from FY21-FY23.

EV sales in India have soared, with a remarkable 87.5% CAGR from FY14-FY22, led by 2-wheelers and followed by 3-wheelers.

Key takeaway: Innovation's track record is clear - it drives significant company growth.

Source: RBIPoised for a 14.7% CAGR over 6 years, expected to overtake traditional television packages.

E-commerce expected to grow 7x in 10 years, with the Indian market projected to be the 2nd largest globally and reach $350 billion.

Key takeaway: These are not mere trends, there's a wave of innovation shaping our economic landscape, presenting an enticing investment opportunity.

Source: EY, Above data is shown for growth in revenue. (Investor relation letter) Subscription service platforms.

IBEF, Invest India

Past performance may or may not be sustained in the future.

Diversified Yet

Targeted

Focus on innovation across market cap and sectors like auto, internet, fintech, specialty chemicals, pharma, etc.

Aligned with the enduring growth of companies at the forefront of innovation.With a high active share, the fund's portfolio actively deviates from the benchmark index, aiming for enhanced performance.

Allocation: 35 - 45%

Sector-leading companies with high investment in R&D.

Internet, software, pharma proprietary products etc.

Allocation: 35 - 45%

Companies that leverage innovation to create a competitive advantage.

Consumer discretionary, financial services, healthcare, etc.

Allocation: 10 - 30%

Companies identifying gaps and creating products/services.

Low innovation, offshore innovators, commodity stocks, etc.

Broad allocation approach, which would depend on the portfolio manager approach/ thesis

You’re a patient investor with a long-term horizon looking to invest in the innovation theme, especially via SIP.

You’re seeking capital appreciation in your satellite portfolio.

You’ve tolerance for high risk that comes with a thematic fund.

Make an informed decision. Learn more about investing in Bandhan Innovation Fund

A thematic fund investing in companies following innovation theme.

10 th April - 24 th April, 2024

Equity portion: Mr. Manish Gunwani

Debt portion: Mr. Brijesh Shah

Overseas portion: Ms. Ritika Behera

During New Fund Offer

And in multiples of Rs. 1/- thereafter

If redeemed/switched out within 30 days from the date of allotment: 0.50% of the applicable NAV

If redeemed/switched out after 30 days from date of allotment - Nil

Regular/Direct Plan: Growth Option and Income Distribution cum capital withdrawal Option^

The Scheme seeks to generate long-term capital appreciation by investing predominantly in equity and equity-related instruments of companies following innovation theme. Disclaimer: There is no assurance or guarantee that the scheme's objectives will be realized.

Manish Gunwani serves as the Head of Equities at Bandhan AMC. With his deep expertise in equity fund management and a distinguished career spanning over 28 years, Manish is celebrated for his strategic approach to wealth creation and consistent track record in the sector. His extensive experience encompasses a broad spectrum of equity research and fund management.

Before his current role, Manish was the Chief Investment Officer - Equities at Nippon India Mutual Fund, managing an equity AUM of over Rs 1.2 lakh crores. He also significantly contributed at ICICI Prudential AMC as the Deputy CIO (Equities), where he was instrumental in growing two flagship funds to a total AUM exceeding Rs. 35,000 crores.

An alumnus of IIT Madras, Manish also holds a postgraduate diploma in management from IIM Bangalore. Beyond his professional sphere, Manish takes a keen interest in reading about historic events and follows football.

(An open-ended equity scheme following an innovation theme)

This product is suitable for investors who are seeking*:

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of Bandhan Mutual Fund (formerly known as IDFC Mutual Fund). The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme's portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither Bandhan Mutual Fund (formerly known as IDFC Mutual Fund)/ Bandhan Mutual Fund Trustee Limited (formerly IDFC AMC Trustee Company Limited) / Bandhan AMC Limited (formerly IDFC Asset Management Company Limited), its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.